The phrase, “We’re living in unprecedented times” has been heard an unprecedented number of times in the last 10 months. We’re longing not to have to use or hear that phrase and for the impact of Covid to disperse as quickly as it came. The tragic loss of life can’t be forgotten but we need the economy to recover as if the pandemic never happened as soon as possible.

From speaking to drivers and business owners we’re all desperate to be able to make plans. To do that, we need to be able to budget our outgoings around our predicted incomings. Vital to that process, for many of our clients, is having a degree of confidence as to how the taxi and private hire industry is going to fare. As a company we know only too well how hard it is to predict financial performance in these highly challenging circumstances. Forecasting 2021 really has been finger in the air type stuff.

There are a vast number of potential sources of information to build some expectations around. Though, those numbers still feel very much like a best guess at the moment and are clearly subject to events unfolding in unexpected ways, it doesn’t stop us trying.

So I thought it might be interesting to look at the share prices of a specific sample of some of the largest companies operating on these shores. The intention is to analyse how their financial performance might relate to some key sources of passenger traffic for the UK’s taxi and private hire drivers.

When will airport runs pick up again? Rolls-Royce Holdings PLC

The last week has seen international arrivals needing to provide a negative COVID-19 test result before flying into England. Though that doesn’t remove the requirement to isolate for 10 days for those coming from countries not on the government’s travel corridor list*. We’ve also seen in recent days travel bans imposed on large chunks of South America as well as Portugal due to a new strain. And with fears over the Kent variant of Covid making Brits equally unpopular potential visitors to many other nations, even amongst a tough financial climate for the wider economy, the year hasn’t started particularly brightly for the travel industry.

That said moneysupermarket.co.uk reports that on average two thirds of households in the UK have saved £7,000 during the crisis. Restrictions on socialising, travel, retail and commuting have actual put more money in some relatively fortunate people’s pockets.

You might know it but British aircraft turbine manufacturer Rolls-Royce operates a “power-by-the-hour” business model. It no longer sell engines, but instead offers “thrust hours” to airlines who aren’t obligated to purchase engines. Instead they pay only for the hours the engines are in use. Rolls-Royce, maintains ownership of the engines and is responsible for their maintenance and repair . Therefore looking at the performance of RR’s share price (and other travel related firms) should give some indication as to what the financial market thinks the outlook is for flights.

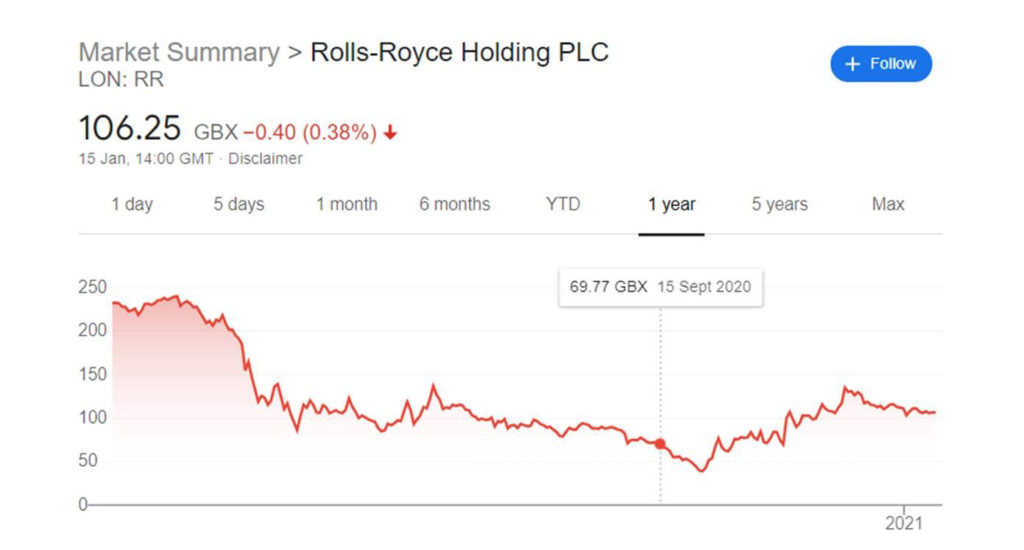

You can see on the graph below that the share price reached a low in October dropping 64% from the start of 2020. However, it received an immediate bounce following the approval of the pfizer vaccine in the UK at the start of December. And it hasn’t suffered too much as a consequence of the 3rd lockdown or the emergence of the Kent virus. The share prices of both IAG (owner of British Airways) and easyJet plc have also risen since November whilst RyanAir Holdings plc is actually trading up since the start of the 2020.

So that might give some cause for confidence. Although traveller volumes are unlikely to bounce back to Pre-Covid levels, the current escalation in cases might not affect the recovery timeline too greatly. If a high percentage of the most at risk sections of the population have had those vital syringes in their arm by late spring we could see people packing their bags and heading off at a fairly high rate. It stands to reason that demand will be there after a year in captivity. Though it’s hard to predict how many people from outside the UK will want to visit if their country’s own vaccine roll out is less rapid.

*Update – A Test to Release scheme is now in place that could reduce the time to 5 days on the basis that another test is paid for and a negative result is received again. However as if to demonstrate how volatile the situation is, in the hours since I wrote this article the UK announced that all travel corridors are closed until at least February 15th.

When will the night time economy start to recover? J D Wetherspoon PLC

Although it’s not necessarily a mecca for millennials, Wetherspoon is the largest UK pub chain and should provide a fair bellwether of our appetite for alcohol outside the home in coming months. Its shares fell 30% during 2020 and that performance was quite strong compared to other pub stocks. Though the first lockdown in particular was catastrophic for the business and a funding was needed from the Government’s Coronavirus Business Interruption Scheme. This partly explains this underperformance compared to the average 25% fall for other Travel & Leisure firms in the FTSE 350 Index.

The hospitality industry has been left on its knees by the virus. Suffering as much as any other sector during the 3 lockdowns, despite investing in making premises “Covid Secure.” However, the data above regarding consumer spending power is just as relevant here. People are desperate to get out and meet up with friends and loved ones. 2021 could see an outpouring of emotions as the restrictions lift. Though the Prime Minister has already stated that the measures will be removed gradually rather than in one large swoop. The hope of a return to would explain why the company’s valuation hasn’t fallen through the floor.

Will workers ever head back to their offices? IWG PLC

You must have heard the news that remote working, as a result of the Covid Crisis, is going to prove the death knell of the office! The world (and the UK’s) largest serviced office operator IWG, formerly Regus lost 75% of its value when the first lockdown struck. But a large number of investors must be tired of their own four walls as its subsequently reduced the deficit to 19%.

IWG has 306 office centres in the UK. Its CEO and founder Mark Dixon is bullish about the future despite a big change in the nature of demand. He believes, “We are going to see a huge number of start-ups in the UK and they will adopt a flexible way of working. We can see the number of new companies created is going up already as people are made redundant and are being forced to take a chance.”

He predicts that city centre offices may well shrink as more companies move into towns closer to their workers homes. Yet he feels many corporates still want larger spaces that enable them to deliver their “identity” and “people to congregate.”

As keen as individuals are for more flexibility in their work life balance, I for one believe that most workers in desk based jobs will still want or even need to visit an office on a regular basis. As nice as it is to avoid the commute a few days a week, the increased ability to collaborate and the benefit of social interaction for mental well-being has been much under estimated in the clamour to write off the office. IWG’s share price appears to back up that opinion. Hopefully it results in footfall on the streets and people needing to get around cities in taxis and private hire vehicles sooner rather than later.

Summary

There are of course specific factors affecting individual company’s share prices. How robustly they’ve performed and how likely they are to flourish in 2021 is not solely dependent on matters relating to the pandemic. That said we hope that the above snapshot analysis proves that it’s not necessarily doomsday in some key areas for the trade. Fingers crossed we might have provided a glimmer of optimism and a shaft of light in amongst these otherwise pretty dark times. Please take care and try to stay safe.

Find out why 96% of our customers have rated us 4 stars or higher by reading our reviews on Feefo.