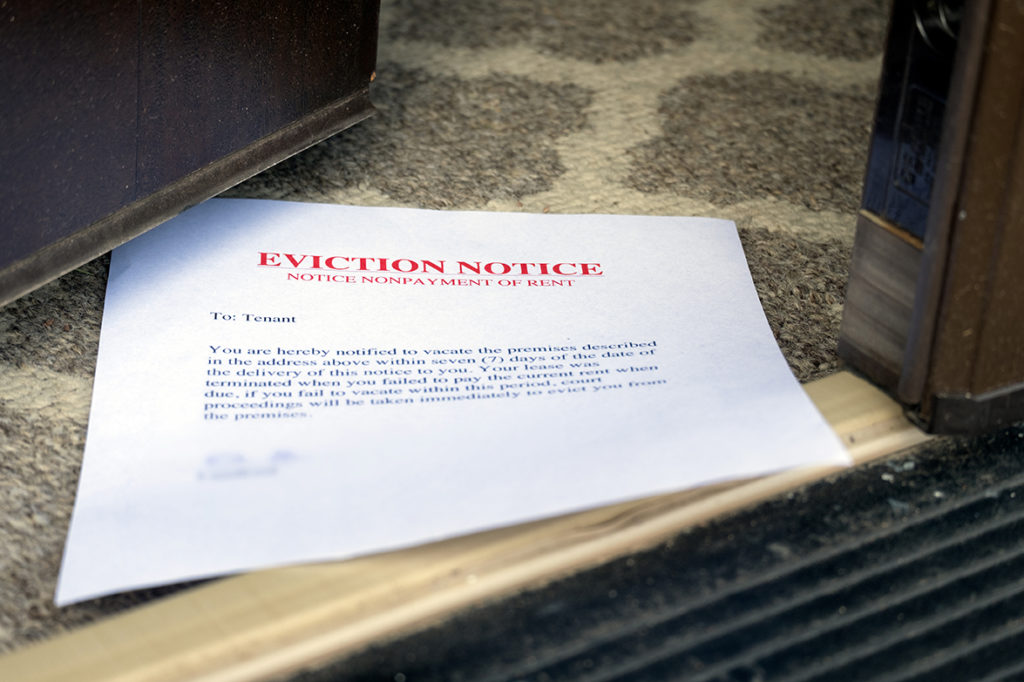

The Government has announced that its ban on tenant evictions will be extended, and that landlords will be prevented from removing renters in England until March 31st.

The further delay prevents eviction notices being issued for another 6 weeks. Robert Jenrick, the Government’s Housing Secretary, stated that the move protects renters “during this difficult time.” Evictions were due to recommence on 22nd February and the ban on them has already been extended from its original date of January 11th. Jenrick claims the government is attempting to strike “the right balance between protecting tenants and enabling landlords to exercise their right to justice.” For this reason some evictions can be still be performed but only in ” the most serious cases.”

The ban on evictions was first introduced at the start of the original lockdown in March 2020. The notice period landlords in England have to provide tenants before ending their tenancy was also increased from 3 to 6 months. In September courts began working their way through a logjam of repossession cases. Cases, such as those involving domestic violence or anti-social behaviour, were prioritised. However a “Christmas truce”, that meant bailiffs could not enforce evictions between December 11th and January 11th was subsequently introduced.

CEO of the National Residential Landlords Association (NRLA), Ben Beadle, warned the measure is creating significant issues further down the line. He highlighted figures showing 800,000 private renters had accrued arrears since the ban was introduced, debts that they will “struggle to ever pay off”. He claims, “It will lead eventually to them having to leave their home and face serious damage to their credit scores.” He is calling for further financial support to combat “the debt crisis renters and landlords are now facing.”

Polly Neate, Shelter’s CEO of the housing and homelessness charity Shelter, echoed Beadle’s sentiments. She issued a stark warning that an “evictions crisis” is looming and pointed to recently published research that found nearly 445,000 adults renting in England are behind on their lease payments or have been hit with an eviction notice in the past 4 weeks. She called for the government to, “Give renters a real way out of debt. That means a lifeline of emergency grants to help pay off ‘Covid arrears’ so people can avoid the terrifying risk of eviction altogether.”

Whilst administrations in Wales and Scotland have issued emergency grants or loans, it does not appear likely that the powers that be in Westminster will follow suit. Though a rent arrears debt crisis is clearly developing as a result of the ban on evictions during the pandemic. Direct financial support for tenants in rent arrears, and landlords losing what could be vital rental income is needed.