What will 2017 hold for the Motor Trade? We take a look at 10 key areas and make some predictions as to what the year could have in store for the industry.

Brexit to hit new Car Sales

2016 was a great year for new car sales. In fact it was the 6th continuous years of growth for the industry’s top 200 franchised dealerships. These traders amassed a combined turnover in excess of £61 billion. This was up 8% on 2015, as were pre-tax profits that reached close to a staggering £1 billion.

But could dark clouds be gathering on the horizon? The Society of Motor Manufacturers & Traders (SMMT) predict that new car sale volumes will fall 5% in 2017 from their record levels to 2.544 million units and Glass’s estimate a 3.5% downturn.

These glum forecasts come despite the market having performed solidly since the Summer’s surprise referendum result. Yet it’s felt in some quarters that the stats might have been cushioned somewhat by long lead times on new car orders. Also the full effects of Article 50 being triggered are still to be seen.

Auto Trader’s CEO Trevor Mather has seen no negative effects of Brexit on the second hand vehicle market. The number of cars posted on the online market place topped 500,000 in November. He confidently says,

“(Our) Audience remains strong, the dealer numbers are strong and stock is strong. Furthermore used car transactions are at an all-time high.”

Consumer buying power in 2016 was supported by sustained, if not staggering GDP growth, low inflation compared to wage rises, strong house price increases that aided buyers’ borrowing prospects – which were further helped by historically low interest rates – and reduced petrol prices.

As we move into 2017, consumer confidence may be hit by issues affecting the wider economy beyond just the uncertainty surrounding Brexit – and an inevitable rise in vehicle costs due to the depreciation of sterling since the nation voted for Brexit.

The oil producing nations of OPEC having struck a deal with their non-cartel competitors to restrict oil production which could see a sharp jump in prices on petrol forecourts.

Private car insurance has risen on average by 18%, with the increases largely blamed by insurers on higher repair bills due to new automotive technology that is proving expensive to replace.

Growth for the Used Car Market

The new year also sees franchised car dealers facing the challenge of increased competition from the car supermarkets sector. According to the Motor Trader magazine’s survey of the UK’s Top 50 Independent Dealers, units sold were set to increase from 7.6 million in 2015 to 8 million in 2016. The combined turnover of the Top 50 increased by 25% to £3.7 bn.

The used market is benefiting from an ample supply of stock which has been provided by healthy volumes of new car purchases. Motor Point – the largest independent trader in the country – retailed over 52,000 vehicles.

According to the report the average price of a dealer supplied car has increased 6% in the past year and now sits around £12,000. This has been aided by the prominence of more exotic and super car specialists in the list.

So the outlook for used car traders appears optimistic with a trend towards more car units sold and a higher average price.

Big Data – Bigger Profits

Generally most traders would like to turn their stock around at a faster rate. Most would agree with Auto Trader’s summary that speed of sale is down to ‘desirability, stock availability, location, specification and price.’

The Ford Galaxy was the fastest selling vehicle on the Auto Trader website for 3 consecutive months. The nation’s number one seller took an average of just 11 days to sell in October.

There is no obvious stand out reasons why it has consistently out-performed all other vehicles, but it is likely that the 7 seater’s popularity is down to a combination of low running costs and large amounts of luggage space.

Although the Ford Galaxy was the best-selling model across the country, to be more precise it was actually the 2012 diesel automatic version that proved most popular in London. Whilst in the North East of England the Ford Focus out performed its larger stable mate, specifically it was the 2013 manual model that sold fastest.

Regional variation might seem to be coincidental but these figures are based on, “Big Data”. Over 500,000 classified ads were published on the Auto Trader in November alone. When you segment a data set of that size you are establishing trends not noting down chance purchases.

Knowledge of the precise models that are wanted in the local area can enable traders to capitalise on demand and shift stock far quicker, or to maximise their margins.

Its claimed that using forecourt strategy apps such as I-control to manage your stock can half the time vehicles remain in your company’s possession. Will 2017 see more and more traders upgrading their stock purchasing processes?

Read more: ABP Club Survey: Tighter Repairer Margins

Read more: Plan Win Insurance Provider of the Year Award

No stopping the Germans

Analysis of the searches carried out by browsers on the Auto Trader platform demonstrates the enduring popularity of premium brands, specifically ones that are produced in Germany.

As a nation we may have voted to leave the EU but our love of German motor manufacturing remains undiminished. BMW, Audi and Mercedes-Benz occupied the top three positions and even Volkswagen, despite being found to have sold 11 million vehicles worldwide with software designed to cheat tests for harmful NOx emissions, came in fourth.

Fortunately for retailers of these brands demand remains strong, as high value cars purchased on PCPs will enter the used car market in large numbers throughout 2017.

Pimped Showrooms

A space age showroom is almost mandatory for a car dealership but The Retail Motor Industry Federation maintains that standards for motor trade retail spaces are beyond what is necessary.

Mid-market brands now compete with their premium rivals and the high-end brands persist with their attempts to out- do one another. But the costs of upgrading existing and purchasing new premises have hit motor trade margins amongst the big players for the second year running.

It is not only the expenditure that affects profits but the disruption to business sales operations. Yet with increased competition don’t expect the trade to take their foot off the gas in pursuit of higher footfall and the wow factor.

Large Mergers & Acquisitions

2016 has seen an acceleration in acquisitions with 12 companies in The Motor Trader Top 200 Franchised Dealer being taken over in the past 12 months. The list showed the top 10 dealer groups now collectively account for 43.8% of the total Motor Trader Top 200 turnover, with their average sales of nearly £2.7bn.

Yet the bottom half of the top 200 companies account for just 10.8% of the total turnover. The top 3 companies are listed below:

Pendragon retained its position as the largest dealer group in the UK with annual turnover of £4.45bn

Sytner in the number two position with annual sales of £4.23bn.

Lookers was in third place £3.64bn.

It’s expected that any new merger or acquisition will take place amongst the big players as the potential returns will need to be substantial to make it worth their while.

Source: informationsecuritybuzz.com

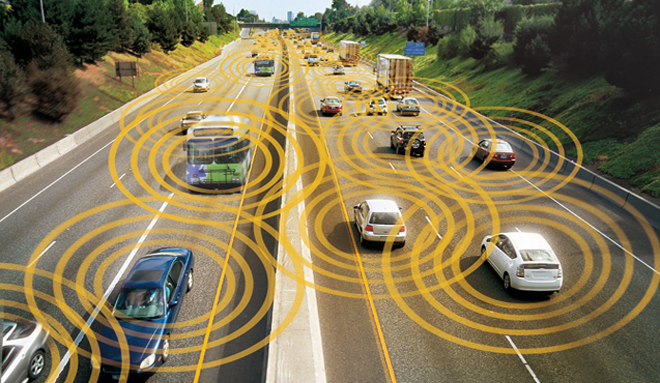

More Connections

Connected cars are garnering almost as many headlines as driverless cars. Most consumers appear focussed on the ability to use their smart phones to operate the infotainment system and to remotely track a vehicle’s where-abouts and disable if needs be.

The media seems preoccupied by cyber security and hackers accessing vehicles’ operating systems.

However connected cars are set to be big business. BI Business Intelligence estimates that more than 380 million connected cars will be on the road by 2021.

It’s with that in mind that RCR Wireless News predicts that in the near future there will be major connected car acquisitions by telecom companies who are keen to capitalise on increased bandwidth requirements and new user purchasing opportunities.

Vans in demand

The SMMT’s commercial vehicle registration figures in November revealed that new van registrations grew by 2.5%, bringing the overall year to date growth at the start of December to 2.1% with a total of 348,448 units registered in the first 11 months of the year.

2.0-2.5 tonne van sales also showed strong growth of 43.1%. Likewise the ‘pick-up’ market rose consistently by 36.7% resulting in an increase of 1,000 units year on year.

Sue Robinson, Director of the National Franchised Dealers Association (NFDA) which represents franchised car and commercial vehicle retailers across the UK, commented that,

With no legislation changes due to happen in the short term, there is a general optimism that the light commercial vehicle market will continue to perform well also in the new year.

The Death of Diesel

In recent years diesel engines have matched and outsold their petrol counterparts. However a recent study by Which Car? found that 70% of the buying public are likely to opt for petrol car in the future. Rather than their purchasing decision being driven by concerns over harmful emission levels it is the potential effect of legislation changes on running costs that are putting them off.

Likewise traditional diesel manufacturers such as Renault are also moving away from producing diesel engines due to high regulatory costs. Yet out of adversity there might lie opportunity.

The motor trade holds high hopes that the government will provide funds for a diesel scrappage scheme. London Mayor Sadiq Khan is pushing for one to help smooth the early introduction of the capital’s Ultra Low Emission Zone.

Incentivising owners of old, high polluting diesel engines to buy a new car could be great news for the trade. Green vehicles are definitely gaining in popularity.

Department for Transport (DfT) figures show the take up of ULEVs has increased by 49%, all be it on relatively low numbers. Yet the cost of electric vehicles (EVs) and hybrid alternatives remain prohibitively expensive for the mass market.

Research by Autovista Intelligence predicts that the total cost of ownership of an EV compared to an equivalent petrol model will not equal out until 2024. The diesel scrappage scheme could bridge the gap in the interim period.

Finance the Key

Our recent blog Google’s Motor Trade Industry Insights revealed that consumers no longer begin the car buying process by searching for car reviews or local dealerships. Instead they use the search engine to find out how much they can afford to borrow.

The issue of finance is now absolutely central to their purchase. Are you giving it sufficient priority? Does your website provide enough information?

Web designers and builders Spidersnet.com offer a simple finance tool that can be incorporated into your site. This plugin could answer your potential client’s questions and prevent them going elsewhere for the new vehicle.

And what about distressed buyers?

With Glass’s director of valuations, Rupert Pontin, predicting that the fall in value of the pound will lead to monthly payments on PCPs rising, he believes manufacturers will stop offering low deposits and discount finance rates in an effort to recoup losses caused by the depreciation of the pound.

Used car traders may also need to work that much harder to offer competitive prices if lending costs go up. Could it be worth refreshing your sales teams’ knowledge by investing in specialist motor finance training? Numerous online competency tests are available.

Another consideration is whether you are able to accommodate customers with no or poor credit history. If not, it might worth establishing a relationship with specialist finance brokers who have with a track record of matching distressed borrowers to suitable lenders, such Ethos Finance. Doing so could be the difference between getting the sale over the line and seeing a potential customer walk rather than drive away.

Read more: Making Money – Google’s motor trade manager gives top tips