The introduction of London’s ULEZ requirements in the New Year has seen many driver’s thoughts turn to the cost of new compliant vehicles.

A number of manufacturers are launching new models in the very near future. It’s hoped that the promise of much lower running costs will overcome concerns regarding initial purchase prices.

However, taxi drivers are legitimately worried that any savings may be offset by higher insurance premiums. Though we’ve received several enquiries from cabbies asking whether any ongoing savings will be offset by much higher insurance premiums? These fears were raised by recent tabloid press headlines that stated electric vehicles cost up to 50% more to insure.

The following blog will provide more information about a range of factors that are set to play a part in the cost of electric taxi insurance.

Vehicle Value

If you currently drive a newish taxi that’s under 3 years old the increase in vehicle value will not be particularly dramatic. But if, for example, you’re operating in a TXII worth around 5K and want to swap to the TX eCity, you could potentially increase the value of your vehicle by 10 times.

This of course represents a greater risk to the insurer due to the potential for larger pay outs for own damage claims and thefts. Though this will not play as significant a role in determining premiums as many people might think.

3rd Party Liability

The cost of damages awarded to 3rd parties make up the majority of most insurance premiums. Take for example young drivers – they often have first cars that are not worth more than a few hundred pounds. Yet their premiums are in the thousands. This is because of the increased risk they pose to pedestrians, other road users and third party property compared to other motorists.

The increased insurance liability risk presented by the electric taxis will be minimal. This is because neither the BHP nor the passenger numbers being carried by the vehicles are substantially different. In fact, compared to older taxis, the new models have far more safety features and may even reduce the risk for insurers.

Repair Lead Times

One concern that insurers have voiced about electric vehicles is over the potential for increased repair costs. On other types of electric vehicles there have been disputes over the cost of parts, as well as the length of time it takes to repair vehicles due to issues sourcing new components.

Take for example the popular Tesla S Model. If one is involved in an accident and an engineer certifies that the battery cell is compromised, the bill to replace it can be around £12,000 to £15,000, in addition to the fitting charges. As it stands, insurers have no indication of what the battery would cost to replace on the new electric taxi models.

Although on the plus side, before anyone begins to panic, a battery cell is made up of far less components than a diesel engine. Logic dictates that if a current taxi vehicle, say a Mercedes Vito, is involved in a significant incident and requires a complete engine rebuild, the bill for the insurer would be in a similar region.

Delays in the repair cycle can greatly inflate bills for insurers. They may be hit with escalated storage and courtesy vehicle charges. Also the longer the claim drags on the more time the insurer’s claims team will have to spend on trying to resolve it. Inevitably with long, drawn out claims there will be more customer complaints. Handling and responding to these complaints appropriately can require an awful lot of time.

Research

From our (admittedly limited) research, reports in the media suggest that standard, non-commercial electric vehicles are up to 50% more expensive to insure appear to be wide of the mark.

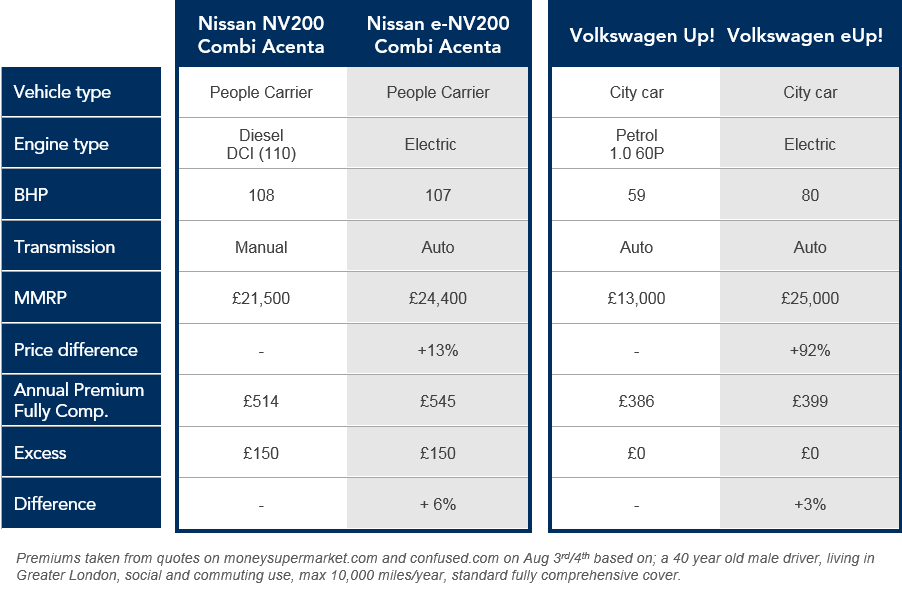

We have looked at a couple of popular models and compared the premiums on two of the major comparison websites. We were very surprised to find out that our results varied greatly from the numbers announced in the press over the past few days.

The increased costs in our table can probably be attributed to the higher vehicle values along with the fact that there currently are fewer insurers in the market for electric vehicles. With less competition for business the prices are likely to be higher.

Conclusion

The very short, truthful answer to the question, “Will electric taxi insurance cover be more expensive?” is that it’s too early to tell. Premiums are dependent on a number of other factors such as age, postcode, no claims bonus but these will be consistent regardless of the vehicle being insured.

However, electric taxis do present an element of the unknown for taxi insurers at the present moment. Many will probably take a ‘suck it and see’ approach. If they instantly raise their premiums to protect themselves against potential higher claims costs then they stand to lose a large number of clients and no business wants to risk that.

So hopefully we’ve allayed fears over any drastic rises in the short term.

– Learn more about commercial insurance.