Updated: 20 July 2025

Your fleet insurance should provide a single streamlined policy to cover all your vehicles. It’s an essential solution for businesses managing multiple vehicles. This fleet insurance guide provides valuable tips to help you select the best fleet insurance provider for your needs. It also explores cover options, cost considerations and key benefits.

Whether your business operates just a few vehicles or manages an extensive mixed fleet, understanding fleet insurance can significantly enhance your operational efficiency.

What is Fleet Insurance?

Fleet insurance is specifically tailored for businesses managing three or more vehicles, enabling all vehicles to be covered under one comprehensive policy. It simplifies administration with a single renewal date and unified documentation, while offering flexibility to easily add or remove vehicles. Policies can cover cars, vans, trucks, coaches, and even specialised agricultural vehicles.

Common Fleet Insurance Terms Explained

Most purchasers of insurance will be familiar with standard motor insurance terms like comprehensive, third party, fire, and theft. However, certain fleet insurance terms warrant clarification:

- Car Fleet Insurance: Ideal for businesses with multiple cars, such as sales teams or mobile workers. It can also include fleets for larger families seeking purely personal use.

- Commercial Fleet Insurance: Covers commercial vehicles including vans and trucks.

- Company Fleet Insurance: General term covering any company-owned vehicles.

- Fleet Insurance Any Driver: Permits any licensed driver authorised by your business, providing operational flexibility. It may have an age restriction or specify vehicle restrictions for certain drivers.

- Mini-Fleet Insurance: Designed for smaller businesses operating between 2-15 vehicles.

Plan Insurance provides a range of Motor Fleet Insurance options. Complete our online quote form, and our experienced brokers will contact you to discuss suitable insurance cover.

Types of Fleet Insurance Coverage Available

When choosing a fleet insurance policy, it’s crucial to consider the level of coverage:

- Contractors Fleets: Covers commercial vehicles used by construction contractors transporting their own materials.

- Courier Insurance: Tailored for businesses frequently delivering customers’ goods on routes with multiple drops.

- Haulage: Suitable for firms transporting goods over longer distances usually with a single drop-off location.

- Private & Public Hire Fleets: Provides cover for the carriage of passengers by taxi, chauffeur, and private hire businesses.

- Self-Drive Hire Fleet Insurance: For vehicle rental companies to insure their customers to drive during each of their vehicle rental periods.

- Mixed Vehicle Fleets: Policies accommodating a combination of vehicle types with varying gross vehicle weights and uses.

Benefits and Additional Coverage Options

Typical fleet insurance policies often include benefits such as Many other tailored solutions:

- Cover for any licensed driver (with age restrictions)

- Flexible monthly payments

- Uninsured loss recovery

- New-for-Old vehicle replacement (often only applies to vehicles less than 1 year old)

- Medical expenses and personal effects cover (cover and specific limits will vary)

- 24-hour emergency, claims, and legal helpline

- Optional UK and European roadside assistance

Many other tailored solutions are also available.

Get a Fleet Insurance Quote From Us

Our new fleet quote form is now live – fast, simple, and designed to get you the cover you need without the hassle.

Critical Factors Affecting Fleet Insurance Costs

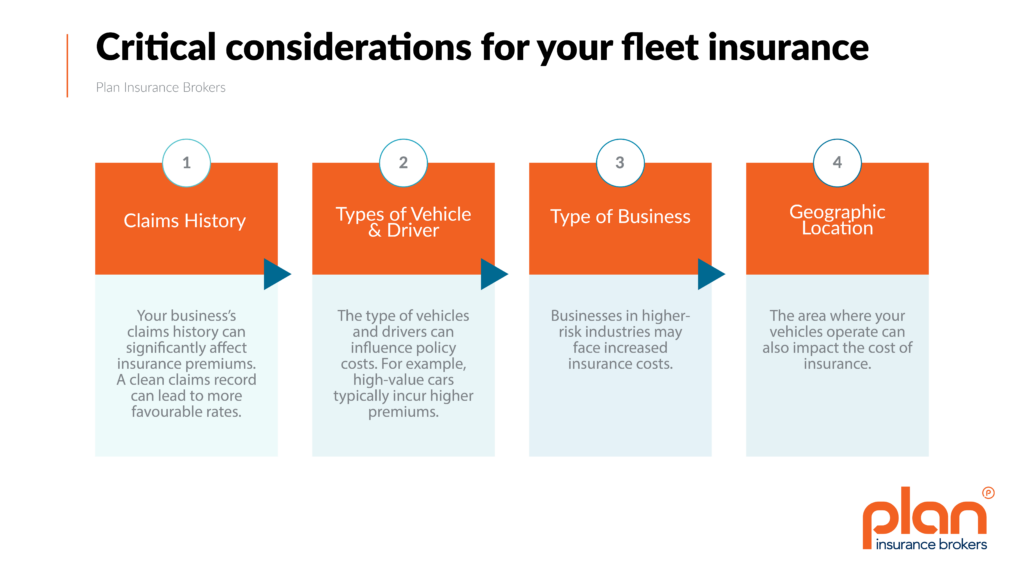

Fleet insurance costs depend on various factors including:

- Claims History: A clean Confirmed Claims Experience (CCE) can significantly lower premiums.

- Vehicle and Driver Types: Premiums vary according to vehicle value and driver profile.

- Business Type: Higher-risk industries typically face higher premiums.

- Operational Area: Geographic location influences risk and thus premium costs.

A No Claims Bonus (NCB) applies to individual vehicle insurance policies. However, insurance underwriters will rely heavily on a CCE which stands for Confirmed Claims Experience. A CCE is used to assess the driving standards and risk presented by your fleet to motor insurers. Maintaining a confirmed claims experience that demonstrates as few claims as possible, as well as restricting those claims to a minimal total value is key to obtaining a competitive fleet insurance premium.

Your confirmed claims experience will provide an accurate claims history from recent years. For that reason, it helps insurers assess risk and set fair premiums. A strong CCE can lead to lower costs and less restrictive cover terms, as a reward to businesses with fewer claims.

Can Telematics Lower Your Fleet Insurance Premium?

Telematics technology provides detailed insights into driver behaviour and vehicle performance, potentially lowering your fleet insurance premiums through:

Real-time Tracking: GPS data to manage fleets more efficiently.

Cost Optimisation: Reducing mileage not only saves on operational costs but the less mileage travelled means the less likelihood of a motor accident occurring.

Enhanced Safety: Monitoring driver behaviour serves to improve compliance and safety.

Improved Customer Service: Reliable and punctual service enhances your brand reputation.

Reduced Insurance Costs: Accurate data decreases fraud risk, supports claim reporting accuracy and reduces claim response times. Intervening quickly is known to be a key factor when seeking to avoid claims costs from escalating.

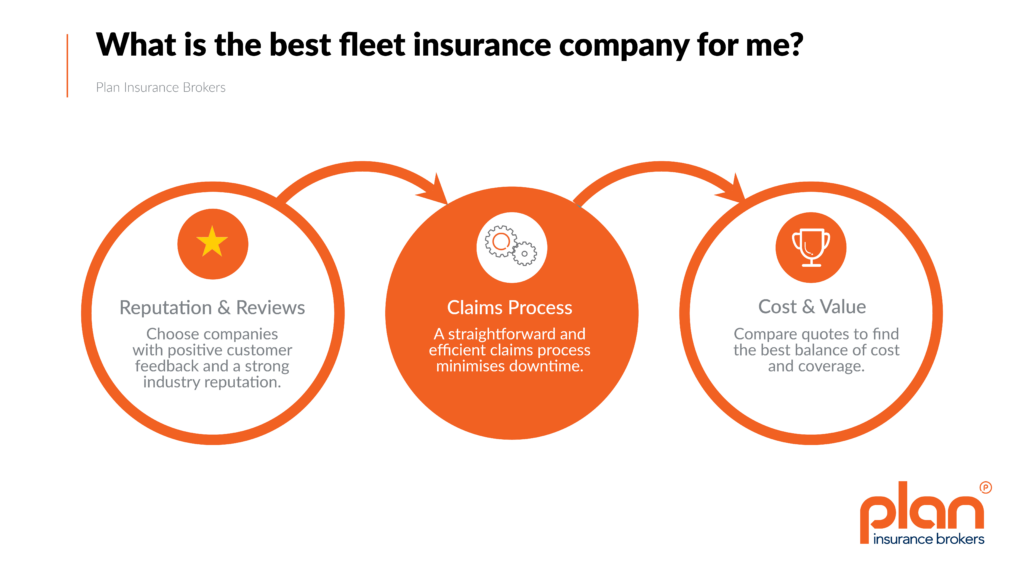

Choosing the Best Fleet Insurance Company For You

Choosing an appropriate insurer is important to ensure suitable cover aligned with your business requirements and budget. Evaluate providers based on:

- Positive customer reviews and solid reputation.

- Efficient and straightforward claims processes.

- Competitive pricing balanced with comprehensive coverage.

Your expert fleet insurance executive at Plan will be able to inform you regarding these selection factors in relation to the available insurers: Get A Fleet Insurance Quote.

For detailed claims information, visit the Association of British Insurers.

How Much Does Fleet Insurance Cost?

Fleet insurance cost depends on multiple factors, including vehicle type, operational location and activity, claims history, driver ages and your chosen insurance broker. A fleet insurance broker can act on your behalf to clearly present your business’s risks to insurers, potentially helping you secure competitive premiums.

Unlike personal vehicle insurance, fleet insurance utilises Confirmed Claims Experience (CCE), which impacts premiums based on your claims history rather than a No Claims Bonus (NCB).

What Other Business Insurance May I Need?

You may consider discussing the following insurance options with your commercial insurance account executive:

- Commercial Combined

- Contractors All Risk

- Goods in Transit

- Professional Indemnity

- Tools Insurance

- Plant Insurance

- Excess Layer Liability

- Property Insurance

- Directors & Officers Insurance

- Cyber Liability Insurance

- Specialist Schemes and Tailored Packages

Plan Insurance Brokers offer comprehensive insurance packages tailored specifically to your industry and risk profile, providing personalised support, risk assessments, and compliance documentation. For further advice on health and safety compliance, consult resources like the Health and Safety Executive (HSE).

Get Your Personalised Fleet Insurance Quote

Fleet insurance is critical for managing business vehicles effectively. Understanding the types of cover, cost factors, and provider selection criteria helps safeguard your operations and streamline your fleet management.

Ready for a tailored fleet insurance solution? – Get Your Fleet Insurance Quote.