The UK Government’s Net Zero target for 2050 (2045 in Scotland) might seem too far off to be a pressing concern for your SME? Irrespective of the disruption caused by the unprecedented heat wave that hit our shores earlier this month, the push towards carbon neutrality might impact your small business sooner than you think.

In this article, we outline the ways the emissions targets might impact your company. We also highlight the support that is available to help your small business should you want to get ahead of the curve when it comes to considering its emissions and to build its green credentials.

Government Targeting Net Zero – What Does IT Mean For SMEs?

In October of 2021 the UK Government laid out its Net Zero Strategy. This is its plan to reduce climate-damaging emissions and to decarbonise all sectors of the UK economy including transport, manufacturing, energy and agriculture. It’s hoped the UK will play a leading part in achieving the ambition of limiting Global warming to 1.5°C.

In 2020, businesses accounted for 18% of all UK greenhouse gas emissions. Over 40 of the UK’s FTSE 100 companies have already signed up to the United Nation’s Race to Zero campaign, cementing the UK’s position as the leader of the international business community in going green and tackling climate change. But what about the UK’s SMEs?

The UK has nearly 6 million small businesses making up nearly 99% of all UK enterprises. They employ 60% of the UK workforce and produce £2.2 trillion of revenue for the economy. Your company might be one of these firms? Clearly SMEs will play a crucial role in the UK hitting its Net Zero target. It will be vital that SMEs take action to reduce their carbon emissions.

So what could the drive to Net Zero mean in practical terms for your small business and our commercial insurance clients? We’ve already seen the ban on fossil fuelled cars that is set to hit vehicle manufacturers in 2030. Potentially further legislation will come into force if it doesn’t appear that the country is moving fast enough towards its required emission levels.

As well as regulatory pressure a lack of oversight when it comes to environmental factors may become an issue in other areas for SMEs. For example, speaking in Parliament in November 2020, MP for Thirsk & Malton, Kevin Hollinrake expressed concern that support for businesses in the future “could be “linked to environmental objectives.” He stated, “I can see a situation where, in future, banks may” look at a business and say, “That business does not sit with our ethical and sustainable goals portfolio. Therefore, it is perhaps not a business we want to support.” Restricted access to lending is just one potential pinch point in the financial sector.

Will A Carbon Plan Become An Requirement For Business Insurance?

Representatives from the Net Zero Insurance Alliance (NZIA) spoke on an expert panel at a recent insurance industry conference. NZIA is a group of over 20 leading Global insurers who have committed to transitioning their underwriting portfolios to net-zero greenhouse gas (GHG) emissions by 2050. Speakers at the event confirmed that in the near future, potentially as soon as 3 years, they envisage underwriters requesting documentation from SME’s outlining their carbon footprint calculations and reduction methodology. They implored brokers to encourage their clients to begin the process of analysing and seeking to minimise their environmental impact (if they’re not doing so already.)

Regardless as to whether those running a company are passionate about Green issues, having a carbon reduction plan in place will stand businesses in very good stead should Government legislation come into force. In the not too distant future there is the very real prospect that leading insurers will make net zero planning part of their underwriting criteria. Potentially they will decline to insure businesses without sufficient evidence that their impact on the climate is being sufficiently prioritised.

Where to Start If Your SME is Confused By Net Zero?

Is your small business unprepared for Net Zero? Don’t know where to begin when it comes to Carbon Footprints? Fear not, you’re not alone in this regard and you still have time to get ahead of the curve. A YouGov survey of more than 1,000 UK SMEs at the start of 2022 found that around 50% of respondents did not know what was meant by the term “net-zero.” 77% were also unsure or did not have strategies in place to reduce carbon emissions over the next three years.

Over 5.5 million SMEs operate in the UK. Research has indicated that in excess of 4 million of those businesses are unlikely to have carbon reduction targets in place. Only just over a tenth had calculated their carbon footprint. An absence of in-house environmental expertise, insufficient funding and a scarcity of time were pointed out by a quarter of those surveyed as being the reasons behind their firms’ lack of action.

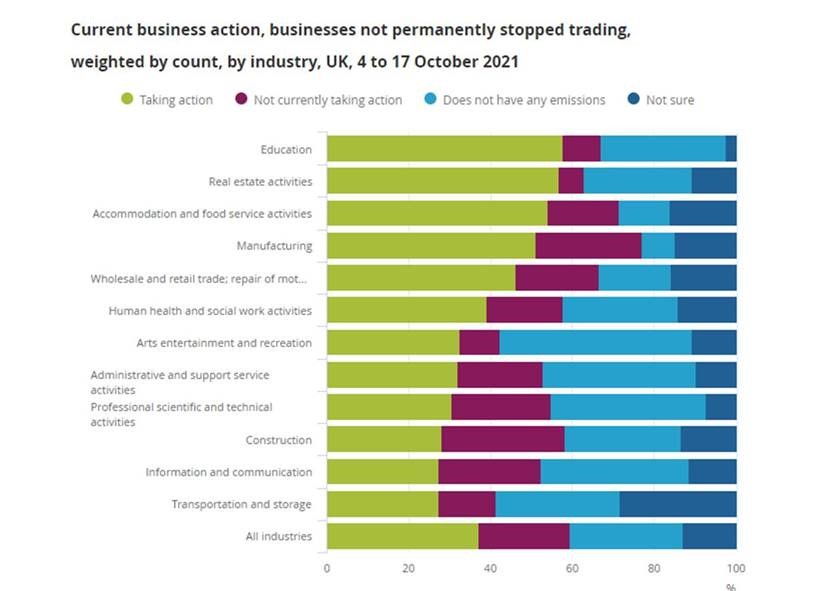

The Office for National Statistics’ (ONS) conducted a Business Insights and Conditions Survey (BICS) between June and October 2021. Over half of businesses in the manufacturing, real estate, accommodation and food service activities, and education industries reported taking at least one action to reduce their emissions. However over a quarter of businesses in the construction and manufacturing industries reported that they were not currently acting.

What Does Net Zero Actually Mean?

As we’ve outlined above, some SME’s are unsure what the definition of Net Zero even is? So what is Net Zero? Put simply by the Governex Group, net zero carbon (or carbon neutrality) means either:

A. Causing zero carbon emissions – e.g. sourcing 100% of energy requirements from renewable / no-carbon energy sources;

or…

B. Removing from the atmosphere the same amount of carbon that is caused by an activity, service, product, etc. – e.g. planting enough trees to offset the same amount of carbon emitted

Where Can SME’s Find Information On Achieving Net Zero?

Late in 2021, the CDP Climate Disclosure Program (CDP) and the SME Climate Hub launched a new framework to help SMEs. The resource will specifically help small businesses measure, report and reduce their climate impacts. It is aimed to tackle the various barriers to decarbonisation highlighted by SME’s such as a lack of expertise.

The tool is called the SME Climate Disclosure Framework and should help SMEs in all sectors to measure and report their direct, power-related and indirect emissions. Definitions for more complex emissions and climate terminology are provided. Additionally there is tailored advice for reducing emissions in line with climate science, taking into account SMEs’ size and sector.

Small businesses are also being given access to some of the UK’s biggest businesses such as, NatWest, Google, Scottish Power and BT. Their climate expertise will be offered to help take practical steps aimed at benefitting the planet.

It is hoped every small business in the UK will start taking small, practical measures to cut their emissions as part of the UK’s journey to net zero by 2050. These actions could be as simple as swapping to energy saving light bulbs, switching to electric vehicles and other cleaner forms of transport to reduce their carbon footprint, introducing cycle to work schemes for employees, moving to environment-friendly packaging etc.

The UK Business Climate Hub has further information for small businesses.

How Can SME’s Analyse their Environmental Impact?

A proactive approach to net zero targets is recommended in order to achieve a smooth transition for your business. The online tools above can outline the required steps to achieve net zero for SMEs. However you may feel like your firm would benefit from additional expert input.

Many ESG advisory businesses are emerging. They can help advise businesses when it comes to reducing carbon emissions as well as corporate governance. Net zero might be best seen in the context of meeting business purpose, strategy, integrity and diversity goals? Therefore questions relating to not only how your SME can make a positive contribution to the environment but also social issues might need answering?

A number of businesses are seeking outside accreditation for their environmental endeavours. Organisations such as B Corp can validate your net zero program. This not only gives you confidence that your work in this area is being effective. B Corp Certification is a “designation that a business is meeting high standards of verified performance, accountability, and transparency on factors from employee benefits and charitable giving to supply chain practices and input materials.” Their endorsement can also can serve as a great selling point to both employees and customers who value responsible businesses.

Future-proofing Whilst Growing a Low Carbon Business

Given the challenging trading conditions currently facing UK SMEs, achieving Net Zero immediately is likely to be prohibitively costly and burdensome to many. There will be only so much that most SMEs are prepared and able to do at the moment. Greater government funding may also be made available if and when further legislation is introduced in order to help deliver the required emission reductions. A focus on quick wins may be your chosen strategy in the here and now. Innovative solutions could present themselves in the course of time. Hopefully, with an open mind to these developments, the greater challenges that exist can be overcome in the future.

Yet, the move to Net Zero need not be seen purely as an inconvenience for your SME. It can have positive outcomes beyond benefitting the environment. In the lead up to UN Climate Summit COP26 in Glasgow last November campaigners encouraged small businesses to pledge to cut their emissions to net zero by 2050 or sooner. They cited the business opportunities that can arise for many companies when adapting to change ahead of competitors. Greater green credentials could potentially help your firm to grow and seize an advantage.

Plan are very pleased to have been short-listed recently in the upcoming UK Broker Awards across several categories, including Best Broker for Sustainability as well as Commercial Lines Broker of the Year. We are well positioned should your business be seeking cover for risks relating to sustainability and electric vehicles.